How to set sales tax rates

Last updated June 16, 2025

Every state and county has different rules about when you should collect sales tax, but Hotplate makes it easy to set separate rates based on pickup locations or menu items.

There are 3 kinds of tax rates you can set on Hotplate:

- Global tax rate - applies to all items sold in your store

- Location tax rate - applies to items ordered to a specific pickup location

- Menu item tax rate - applies to specific items sold

Keep in mind: Hotplate helps you collect the right amount in tax, but we do not report or send the collected tax to your state. If you have any questions about which items are taxable or when and how to report collected taxes to the state, we recommend reaching out directly to your tax professional or state tax offices. Sometimes even a simple Google search of “Sales Tax + [COUNTY NAME]” will get you some quick answers.

Global Tax Rate

To set a global tax rate:

- Go to Settings

- Under General, enter in the rate you'd like to use:

Location Tax Rates

If you sell in different locations that have different local tax rates, you can add custom tax rates to each pickup location. This custom rate will apply to all items in orders that use this location. Your global rate will continue to apply in locations that do not have a custom tax rate set.

To set a location specific tax rate:

- When creating an event, create or edit a pickup location

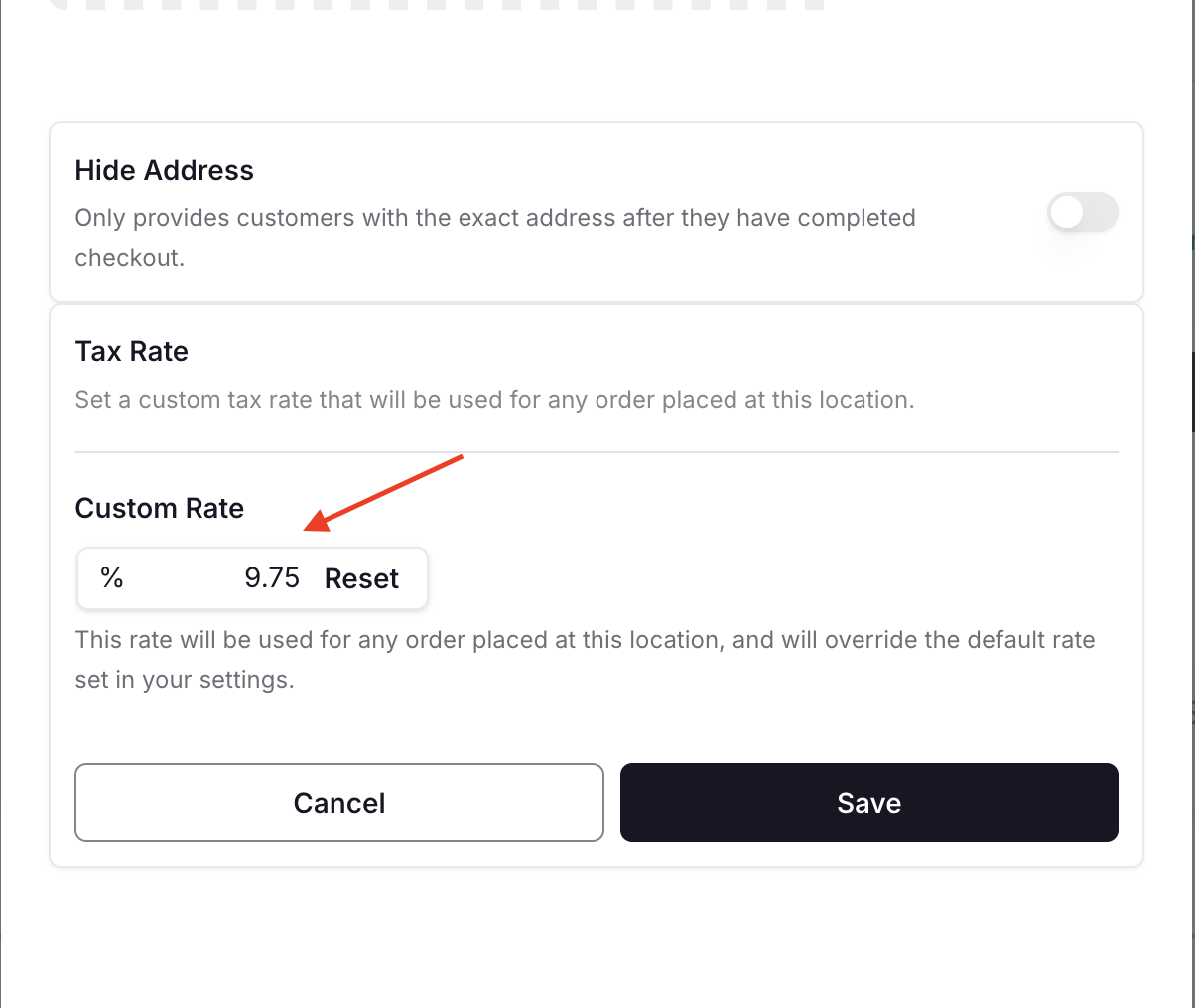

- At the bottom, look for a section labeled Tax Rate

- Click Set

- Enter a custom tax rate:

- Click Save

The custom rate will now appear in your list of locations, helping you remember that a different rate will be used for all orders for this location:

Menu Item Tax Rates

Some items may be taxed differently under your local tax laws, so you can set up specific rates per menu item. If a menu item has a custom rate, it will be used at checkout to calculate taxes instead of any location or global tax rates.

Setting a custom tax rate for a menu item works the same as for a location. Start by creating or editing a menu item and scroll to the Tax Rate section. Additionally, items can be set to Tax Exempt, which means that no taxes will be calculated for the item at checkout.

Similarly, items with custom tax rates (or set as tax exempt) will clearly display these custom settings in the menu item selection list:

I have several rates set - which one will apply?

Setting multiple rates sometimes gets messy or confusing, but you can remember that only one tax rate will apply per item. The system will first check for an item rate (or exemption), then location rate, then global rate. Here’s what we mean:

- If the item is marked "Exempt," no taxes will be applied.

- If the item has a custom rate, it will be applied. No other rates (location or global) will be applied.

- If no custom rate is set for the item, the custom rate for the selected location at checkout will apply. The global rate will not be applied.

- If neither the item nor the location has a custom rate, the default global tax rate (set in your account settings) will be used.

Example

Imagine you’re managing orders for two pop-up events with varying tax requirements for the Downtown and Suburban pickup locations. The global rate for your store is 5% tax on items (assuming the item isn't tax exempt).

For this event, you're selling three types of items: Gourmet Sandwiches, Bottled Beverages, and T-shirts.

- Gourmet Sandwiches are tax exempt

- Bottled Beverages don’t have a specific tax rate, so they follow the tax rate based on the location they’re sold.

- T-shirts have a custom tax rate of 7.5%.

At the Downtown Location

The Downtown Location has a location tax rate of 8.25%. Here’s how the tax rates will apply:

- Gourmet Sandwich: Since this item is marked as tax-exempt, no tax will be applied, even though the Downtown Location has a custom rate, and even though you have a global rate of 5%.

- Bottled Beverage: With no custom rate on the beverage itself, the Downtown Location’s rate of 8.25% will apply.

- T-shirt: Even though the Downtown Location has a rate of 8.25%, the T-shirts have an item rate of 7.5%. This means that customers will be charged 7.5% tax on this item.

At the Suburban Location

The Suburban Location doesn’t have a custom location tax rate, so items here will use the global tax rate (5%) unless specified otherwise.

- Gourmet Sandwich: Since this item is marked as tax-exempt, no tax will be applied, even though you have a global rate of 5%.

- Bottled Beverage: Since there’s no custom rate for this item or the location, the global tax rate of 5% will apply.

- T-shirt: The custom item rate of 7.5% will still apply, regardless of location.